Why We Built This: The Vision Behind Silkroad Capital & Smartprofit Finder Digital Assets

By Katarzyna Lomnicka

It wasn't a single moment that made us realize this space needed fixing — it was a journey. I started in the institutional world, working with top-tier banks and capital markets players. But as I began working more closely with private investors — particularly in Switzerland — something struck me hard:

Even the most well-capitalized investors struggled to access private equity.

They wanted exposure to cutting-edge companies like SpaceX or OpenAI, but the complexity, fragmentation, and exclusivity of these markets kept them out. A Swiss family office wanted to invest €500K in a Series B AI startup. Traditional process: 6-week legal review, 3 intermediaries, €50K in fees, and they missed the round. With our platform: same investment, 48-hour settlement, transparent pricing.

We knew there had to be a better way. A way to democratize access to the most exciting parts of the global economy — while maintaining the integrity and structure that institutional investors demand.

Our first product we called AI Revolution — a thematic investment vehicle focused on emerging tech and AI. We built it with Swiss investors in mind. It worked. But then something surprising happened:

Demand started coming in from outside Switzerland.

We realized that if we wanted to make these opportunities truly borderless, we had to rethink everything — not just product design, but infrastructure, settlement, onboarding, and compliance. That's where the idea of using digital securities came into play.

With tokenization and programmable settlement, we could:

In short, we could build a next-generation capital market, from the ground up.

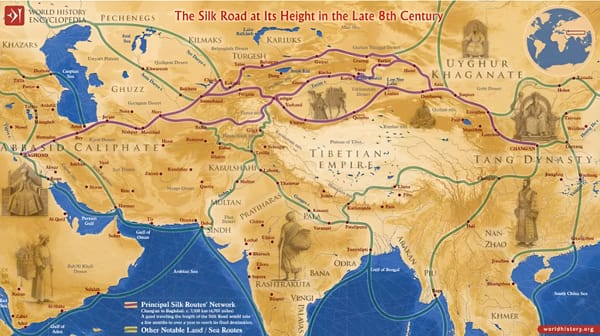

Before we built the investment platform, we were exploring a completely different problem: logistics.

We were exploring freight optimization between Zurich and Istanbul when we realized: the same fragmentation that slows physical goods also paralyzes capital flows. Complex routes, multiple intermediaries, settlement delays — we were looking at movement of goods across Europe, Central Asia, and the Middle East — inspired by the historical Silk Road. That exploration led us to realize something deeper:

It's not just about moving goods anymore — it's about moving ideas, capital, and digital assets.

We carried that spirit into our financial platform. Just like the ancient trade routes connected East and West, Silkroad is designed to connect investors, founders, and opportunities across jurisdictions — safely, efficiently, and intelligently.

It's a name rooted in logistical vision — and transformed for a digital, capital-first future.

This isn't just a UX layer. Behind the scenes, we invested heavily in:

We also built a Swiss-based product pipeline around private credit and private equity, allowing both structured deals and thematic investment opportunities to coexist under one interface.

We believe we're still just at the beginning.

The next phase of Smart Profit Finder — and Silkroad — is about unlocking private markets using AI.

We want to enable investors to:

This isn't just about technology. It's about giving power back to the investor.

We're inspired by the courage of our founding partners, the vision of the entrepreneurs we work with, and the investors who trust us to build what's next.

As Peter Frankopan writes in The New Silk Roads, history is always in motion. The same applies to capital, ideas, and the tools we use to build the future.

This is why we built this — and what we'll keep building.

Comments